How Fastenal Made the ‘Big Pivot’ that Paid Big Dividends

By John Gunderson, Senior Consultant

This article was reprinted with permission from Modern Distribution Management (MDM). It is a great publication and we highly recommend becoming an MDM Premium subscriber, for over 50 years MDM has provided industry leading content for B2B Manufacturers and Distributors. Become an MDM Premium subscriber at https://www.mdm.com/subscribe_premium/

A decade ago I worked for a large B2B distributor 151 miles down the Mississippi River from a B2B distributor in Winona, Minnesota that you might know… named Fastenal. We were not in the same channel, but we operated our businesses in a similar fashion, so we followed what the Minnesotans did with interest.

Whether or not you were in their distribution channel, you probably thought of Fastenal like I did back in 2013 as the distributor with a branch in every sizeable city in America. These smaller branch warehouses were often in the same neighborhood as food/industrial plants or contractors that they served. Fastenal had two to three white pickup trucks sitting out front of every location, and they would throw a few boxes in the truck bed and make deliveries to end customers promptly.

Fastenal in 2013 was one of the leading local convenience-store B2B distributors before the term was probably ever thought of or invented.

Back then, the B2B distribution business was simpler and the winning playbook was straightforward. You put a great branch near the end customers, stocked the branch properly, had great delivery services and backed it with experienced, knowledgeable account managers and support. Success with this four-step approach, executed well, was highly likely.

BUT, Fastenal leadership obviously saw that the four-step playbook was not going to ensure success as-is in the future.

Fastenal made the big pivot sometime in 2013 or 2014 that many other distributors probably never saw coming at the time. I think it was way more than a strategy tweak or pivot; it was more like a full stop and a 180-degree change from what had made them successful and grow up until that point.

If there is one series of meetings that I wish could time travel back to and be a fly-on-the-wall observer for, it would be these Fastenal strategy pivot meetings that must have happened somewhere around 2013. How they got to the first “Big Pivot” and what data and analytics they used is a mystery to me, but since they are a publicly traded company, I will attempt a detective-style analysis of their public reports on what might have happened.

As every good detective mystery story fan knows, let’s start with the facts.

Then and Now

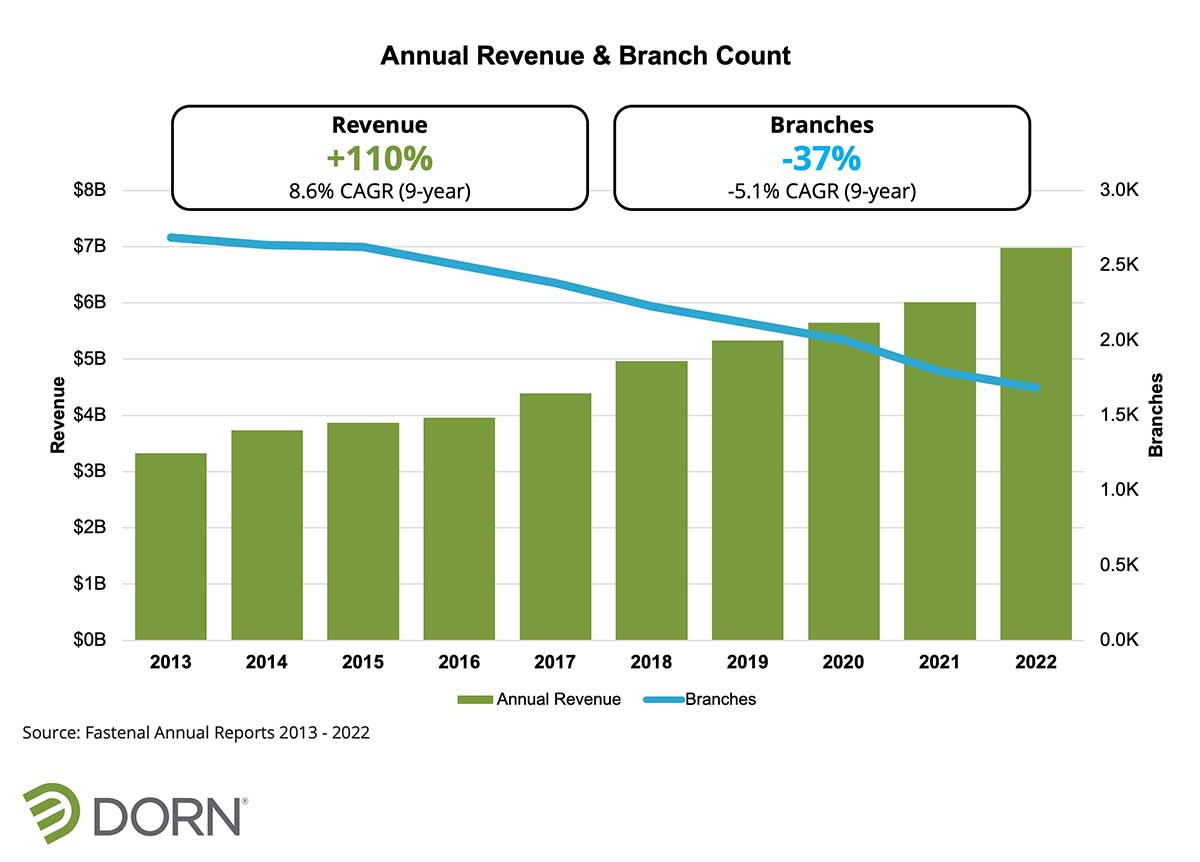

From 2013 to 2022, Fastenal had sales growth from $3.33 billion to $6.98 billion. They more than doubled their sales volume with no major acquisitions in 10 years (primarily organic growth). The facts are: way above market topline sales growth — a big green impressive checkmark.

So, as detective, you might immediately assume that Fastenal must have achieved this great growth by adding more branch locations. That was their pre-2013 playbook, and if they did that, they probably now have 100,000+ white pickup trucks delivering supplies and have made Ford Motor Company one very happy manufacturer.

That is not the playbook they followed. Local Fastenal branches were at their peak in 2013 with 2,687 branch locations. At the end of 2022, Fastenal had 1,683 branch locations (a decline of 1,000+) and they certainly have fewer white pickup trucks in their current delivery fleet.

So, you can more than double your sales while reducing branch locations by about 40%? That math doesn’t add up in the Distribution 101, four-step playbook from 2013.

How did Fastenal make that fundamental change, and what drove the strategy change? Whatever series of changes they made likely leveraged data and analytics, as they are market leaders. Fastenal charted at No. 6 on MDM’s 2023 Top Industrial Distributors List.

The Role Digital Changes Played in Fastenal’s Big Pivot

In looking for the facts, let’s take a deep dive into digital statistics. If you remember in the early 2010s, many of you had a smartphone called a Blackberry. As I tell my kids, it had a full miniature keyboard to send emails and texts and was revolutionary. (If you had one, I recommend you try and explain what it did, and how it worked to anyone under 15. You will find their perplexed looks fascinating).

In 2012, smartphone units sold were 472 million worldwide. Then, with the iPhone revolution, smartphone units sold nearly tripled to 1.24B in 2014. (For comparison, 2023 smartphone units sold are projected to be 1.34B).

In 2014, data speed wasn’t keeping pace (we were probably on 2G or 3G), broadband access and Wi-Fi with speed was not there yet; it was a future-state prediction. It took some time for the infrastructure to catch up to create our current digital experience.

Somewhere in Winona, I suspect the leaders of Fastenal were watching these digital data points closely and planning for a different future state.

Did the Digital Revolution Change the Customer?

The answer we all agree on today is yes, but it was not accepted as fact in 2013. The 2013 B2B Distribution Playbook was simple — it was heavily a face-to face relationship business. The math was simple: the more calls your outside account managers could make on customers, the more those customers would buy. You built your sales process on this foundation of face-to-face interactions and relationships.

Before digital-first times, your team was a key driver of customer training. You marketed to end customers using events, counter days and hands-on lunch-and-learn training. Relationship selling dominated. Manufacturers tried to grow share by fighting for shelf space and mindshare with the distributor vs. the end customer.

In 2013, you won together by having the best team, with the right inventory, in branches near the customer to ensure delivery excellence.

Delivery and Availability’s Competitive Advantage Will Decline

Fastenal may have used data and trending to determine that, long-term, as the end customer became more digital and self-service-oriented, the company would need to adjust its inventory and delivery model for many customers. They must have determined that customers would want their inventory not on the local branch shelf, but in their facility for immediate use.

Self-service distributor support on the factory floor had already started years before 2013 with vending machines, integrated supply support and managed inventory services. The digital and technological advances made it much easier for distributors to put self-service vending machines on the plant floor and accelerated that process.

Digital advancements have supercharged the growth of self-service, onsite inventory for end customers. Fastenal was not alone in recognizing this onsite vending trend early — Motion, Grainger and many others were executing similar strategies — but Fastenal decided to go all-in with it. Fastenal first mentioned vending in their annual reports by about 2010, and by 2012 they had 20,162 vending machine signings. At the end of September 2023, they had over 110,000 weighted devices — a term the company uses to cover FASTBin/FastVend installations & machine-equivalent units — onsite at end customers.

I did a little more sleuthing on the average size of their vending machines to estimate that a device averages about 15.75 square feet of space. If my estimate is close, Fastenal occupies about 1.735 million square feet of floor space at end customers with self-service solutions. That is a pretty incredible amount of “shelf space” and real estate they occupy at end customers today.